Money laundering vs terrorist financing: 4 key differences

Money laundering and terrorism financing are similar phenomena, but with multiple differences. Here we explain the main distinctions.

A systemfor the prevention of money laundering and terrorism financing must take into account the particularities of each of these crimes. Although the two expressions appear to be analogous, they differ in motivation, intention and source of funds.

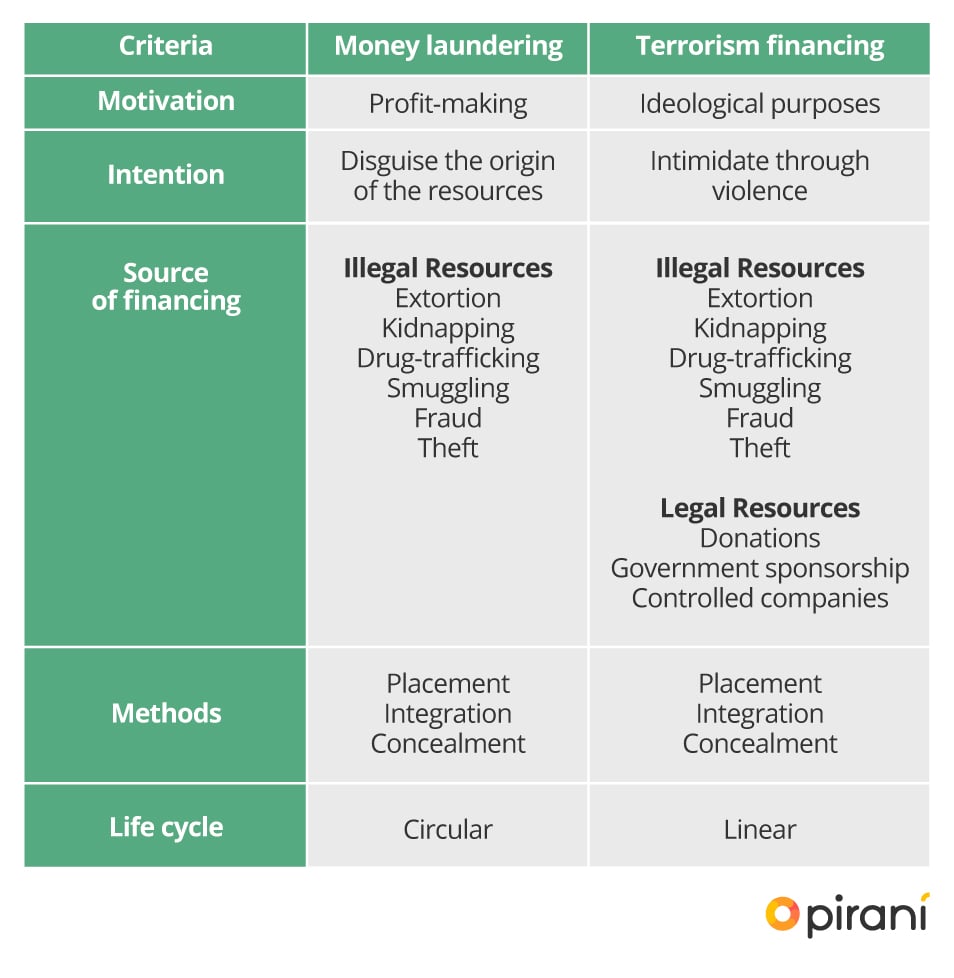

1. Motivation

The expression money laundering refers to an illegal past action that yielded illicit economic rewards. Therefore, the main motivation for money laundering is to profit from criminal activities.

Meanwhile, terrorism financing refers to a future illegal action: it is not a question of hiding the source of funds produced by past illegal actions or enjoying profits in the future, but rather raising money in any way, legal or illegal, to carry out terrorist acts in the near future. That is why the motivation for financing terrorism is ideological rather than lucrative.

2. Intention

The stages of money laundering are understood as a process through which illegal funds are integrated in the financial system. That money is incorporated into the formal economy through multiple operations: purchasing front companies, investing in real estate or commercial projects. This way, drug traffickers circumvent the authorities and enjoy the benefits of their criminal actions. Therefore, its main intention is to hide illicit money for the sole purpose of producing more money.

In turn, financing terrorism is not aimed at hiding money produced illegally, but rather at finding funds to finance criminal acts to intimidate a State or a population through fear, violence and coercion.

3. Source of financing

The main difference between money laundering and terrorism financing is the origin of the funds.

On one hand, financing terrorism consists of collecting capital to carry out terrorist activities. Money laundering, on the other, refers to a process used by a criminal to make his illicit funds appear legal.

Thus, terrorism financing raises money for illegal political purposes, but the source of those funds is not necessarily illegal. Terrorists can obtain funding through government sponsors, corporate contributions, donations, and even legitimate business activities. Of course, they also rely on illegal businesses, such as organized crime, smuggling or evasion.

In contrast, money laundering always involves an illegal source of funds, as its intention is not collection but accumulation.

4. Life cycle

Based on the foregoing, it can be concluded that the life cycle of one and the other is also different. Money laundering operates in a cyclical manner: the money collected by drug trafficking is introduced into the economy, hidden in various transactions and then reincorporated into the financial system. This money, once it looks legitimate, is reused to finance further illegal actions that help generate more illicit money, thus repeating the same "laundering" process.

In terrorism financing, the life cycle is linear: funds are raised, placed in the economic system, and eventually hidden and integrated into the financial system so that they can then be used for terrorist purposes. In other words, the funds are not necessarily reinvested to generate greater profits, but rather to be used practically in the organization's activities.

The table below summarizes these differences between money laundering and terrorism financing.

Although the two phenomena differ in many ways, they often materialize through the same vulnerabilities of the financial system.

Both terrorists and drug traffickers use anonymity techniques to evade the attention of the authorities and to protect the identity of their sponsors or beneficiaries. However, transactions associated with terrorism financing tend to be carried out in small amounts. That is why, when terrorists raise money from legitimate sources, it becomes very difficult to trace the origin of these funds.

However, there is a set of good practices for preventing money laundering and terrorism financing, such as customer segmentation, processes such as KYC (Know Your Customer), customer registration or the management of unusual transactions that allow the control and monitoring of any suspicious transactions.

Likewise, you can use a technological tool such as Pirani that will allow you to identify, measure, control and monitor in an easier way, the risks of money laundering and terrorist financing in time, to prevent their materialization or mitigate their impact in case they occur.

*This article has been reviewed and validated by Camilo Ruiz,a business administrator with experience in LAFT risk management.

You May Also Like

These Related Stories

Money laundering and terrorism financing risks

Learn how money laundering networks operate

Learn about the three stages of money laundering in Latin America

3 tools for monitoring unusual transactions

What are the methods for money laundering?

No Comments Yet

Let us know what you think