Main risk management strategies

by Risk Management School on 26 de July de 2024

In this class, Alejandro Orrego, CEO at Pirani, teaches us about why are you doing risk management, and risk management cycle

Why are you doing risk management?

Defensive - Perspective

- Protecting Assets and Investments

One of the primary reasons for companies to engage in risk management is to safeguard their assets and investments. Risks such as financial losses, operational disruptions, and reputational damage can pose significant threats to a company's resources and capital. - Compliance and Legal Requirements

Regulatory requirements often mandate companies to have effective risk management processes in place. Adhering to these regulations helps organizations avoid legal consequences and ensures that they operate within the boundaries of the law. - Preserving Reputation

Reputational risk is a critical concern for businesses. Negative events, such as product recalls, ethical misconduct, or environmental incidents, can harm a company's image and erode customer trust. Effective risk management helps prevent or mitigate these risks. - Financial Stability

Companies need to maintain financial stability to ensure their continued existence. By identifying and managing financial risks, such as market fluctuations, interest rate changes, and currency exchange rate risks, organizations can avoid financial crises and insolvency. - Insurance and Cost Reduction

Implementing risk management strategies allows companies to identify insurable risks. By transferring some risks through insurance, businesses can mitigate the financial impact of certain events. Additionally, effective risk management can lead to cost reduction by avoiding unnecessary expenditures resulting from unforeseen events.

Proactive - Perspective

- Strategic Decision-Making

Proactive risk management allows organizations to align risk considerations with strategic decision-making. By understanding potential risks and opportunities, companies can make informed choices that contribute to the achievement of their objectives. - Innovation and Growth

Managing risks proactively can foster a culture of innovation and entrepreneurship within a company. Organizations that are willing to take calculated risks are more likely to identify new opportunities for growth and market expansion. - Enhanced Resilience

Proactive risk management contributes to organizational resilience. Companies that anticipate and prepare for potential challenges are better equipped to navigate uncertainties and disruptions, ensuring continuity and sustainability. - Competitive Advantage

Proactively managing risks can provide a competitive advantage. Companies that are resilient and adaptive to changing environments are more likely to outperform competitors and maintain their market position. - Stakeholder Confidence

Demonstrating a commitment to risk management practices enhances stakeholder confidence. Customers, investors, and partners are more likely to trust and engage with organizations that have robust risk management processes in place.

Emerging risk to enhance RESILIENCE

Business Continuity

Business continuity refers to the ability of an organization to maintain essential functions and operations during and after a disruptive event. It involves the development and implementation of plans, processes, and procedures to ensure the continued delivery of products and services to customers, the preservation of critical assets, and the management of risks that could disrupt business operations.

Business Resilience

Business resilience goes beyond continuity and focuses on the organization's ability to adapt, recover, and thrive in the face of adversity. It encompasses not only the ability to respond effectively to disruptive events but also the capacity to anticipate, prevent, and mitigate risks, as well as the capability to innovate, learn, and evolve in a dynamic and uncertain business environment. Business resilience involves building a culture of resilience, fostering flexibility, agility, and creativity, and integrating risk management into strategic decision-making processes to enhance the organization's ability to withstand and recover from disruptions and achieve long-term success.

IDENTIFY CONTEXT | SWOT ANALYSIS

The first step is to understand your internal and external environment and how it influences your strategic direction and priorities. You need to identify the key drivers, trends, uncertainties, and scenarios that may affect your industry, market, customers, competitors, and regulators. You also need to evaluate your strengths, weaknesses, opportunities, and threats (SWOT).

This will help you define your strategic context and the critical factors that shape your risk profile.

|

STRENGTHS

|

WEAKNESSES

|

|

OPPORTUNITIES

|

THREATS

|

IDENTIFY CONTEXT | Frameworks

CONTEXT ASSESSMENT

A framework is a tool used in strategic analysis to assess and understand the external macro-environmental factors that may impact an organization or its industry.

Each of these factors represents a category of external influences that can affect the operations, performance, and strategies of a business.By analyzing these categories of external factors organizations can gain insights into the opportunities and threats present in their external environment, allowing them to develop informed strategies and make better decisions to navigate and adapt to changing market conditions.

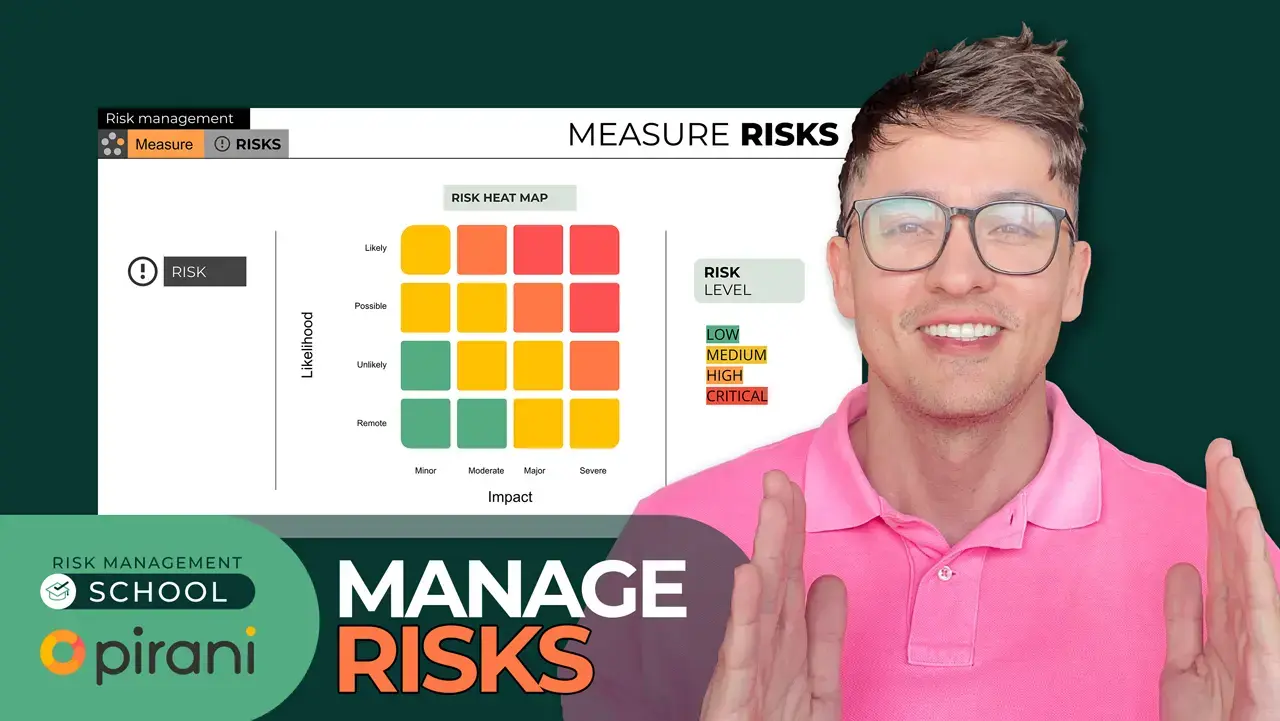

MEASURE RISKS

IMPACT

Impact refers to the potential consequences or effects of a risk event on an organization's objectives. The impact can be positive (an opportunity) or negative (a threat), and can affect various aspects of the organization, such as financial performance, reputation, safety, or environmental factors.

LIKELIHOOD

Likelihood refers to the probability or chance of a risk event occurring. It is a measure of the frequency or occurrence of the risk, and can be expressed qualitatively (e.g., low, medium, high) or quantitatively (e.g., a percentage or frequency rate).

Risk Management Strategies RISK CAPACITY

The next step is to establish your risk appetite and tolerance, based on your strategic context and your stakeholders' expectations. You need to articulate the amount and type of risk that you are willing to take or accept in each of your strategic areas, such as growth, innovation, quality, reputation, compliance, and sustainability.

You also need to specify the level of variation from your expected outcomes that you can withstand in each area, and the indicators and thresholds that will trigger actions or escalation. This will help you communicate your risk preferences and boundaries to your team and your partners.

10 MAIN RISK MANAGEMENT STRATEGIES

1. Avoidance

This involves taking steps to eliminate the risk altogether. For example, if a company decides to avoid the risk of a certain product line, it may choose to discontinue that product line entirely.

2. Mitigation

This involves taking steps to reduce the likelihood or impact of the risk. For example, if a company identifies a cybersecurity risk, it may implement additional security measures to reduce the likelihood of a cyber attack.

3. Transfer

This involves transferring the risk to another party, such as an insurance company. For example, a company may purchase insurance to transfer the risk of a natural disaster or other event that could result in financial losses.

4. Acceptance

This involves accepting the risk without taking any further action. This may be appropriate if the likelihood and impact of the risk are deemed to be low, or if the cost of mitigating the risk is greater than the potential impact.

The 4Ts of risk management

- Terminate

- Treat

- Transfer

- Tolerate

- Loss Prevention

- Loss Reduction

- Sharing

- Spreading Diversification

- Contingency Planning

- Exploitation

You May Also Like

These Related Stories

How to make a risk management matrix

How to build an effective risk management culture

No Comments Yet

Let us know what you think