Banco de Bogotá strengthens in-house risk management with Pirani solutions

Company information

Banco de Bogotá was the first financial institution to start operating in Colombia in November 15, 1870, thus overcoming the Government crisis of 1876 and the War of a Thousand Days, becoming the second largest bank in the country by size of assets up to now.

It has a universal banking model that serves all market segments focused on the highest quality standards. It is currently operating in more than 12 countries in the region. Due to its track record, it has managed to become a banking benchmark.

Highlights: Taken from Banco de Bogotá's 2018 Risk Management Report.

What was the challenge?

In 2008, Banco de Bogotá managed risk management through Excel. Since it was one of the largest banking entities in the country, the high volume of information being condensed generated the following drawbacks: operational burden in reporting, delays in data consolidation, duplication, difficulty in the integration of risk information with events and it made the task of updating controls and events tedious.

The challenge in this case was to match all the risks identified with the events, have updated data to facilitate reporting, and once this was achieved, continue with the procedure of decentralizing the information regarding the risks posed by each of the process owners, thus driving the active participation of all members of the organization.

This is how we managed to solve it

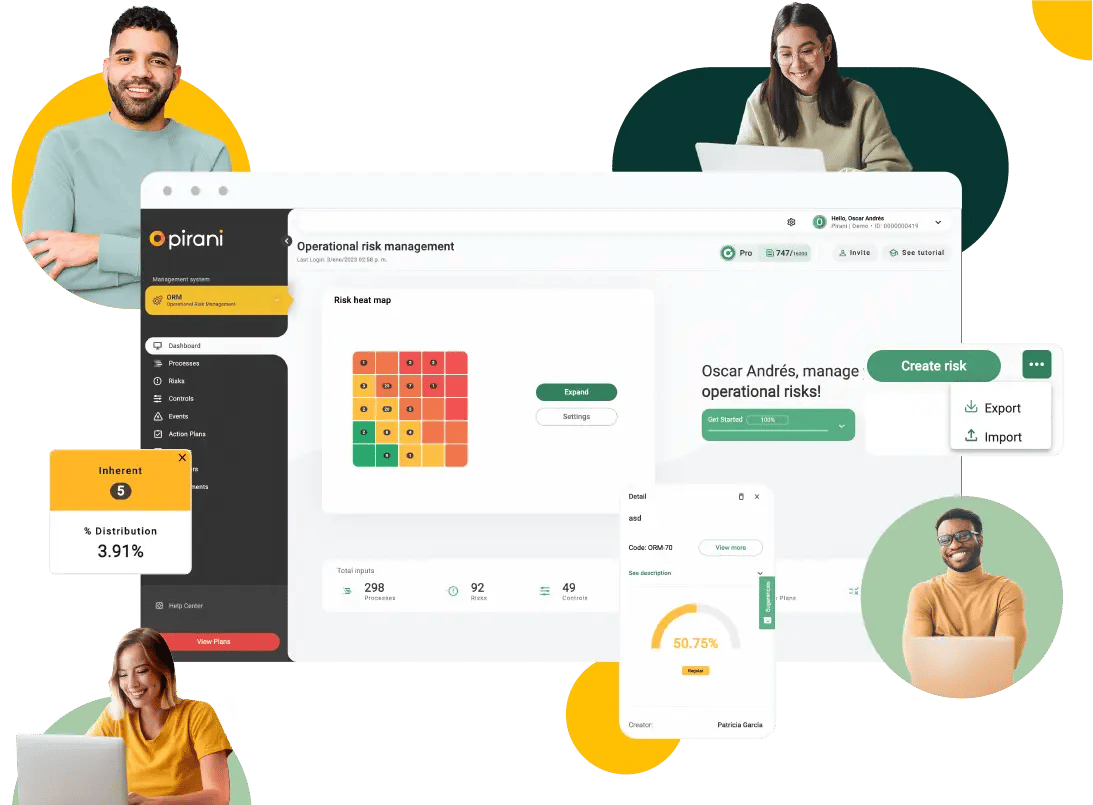

With the arrival of Piraní more than ten years ago and the implementation of the Piraní Risk ORM solution, risk management was decentralized to all levels of the organization, thus fulfilling the set objectives. This provided each process owner with access to consult their risk profile in order to be able to conduct assessments thereof through the application, creating action plans for each of them and assigning the respective responsible parties.

The benefit thereof was the time saved on the implementation of the different tasks proposed in the risk management process, creating a culture within the company, thus reducing the use of its basic Excel resource and minimizing unnecessary meetings or activities that slow down the processes or make them more time-consuming. This led to more agile and effective management, bringing great benefits to the employees and the company itself.