Excel Matrix vs. Risk Management Software: Which is better?

Managers often use an Excel file to manage risk. While these types of tools are easy to use, they also have several limitations. Learn what these limitations are.

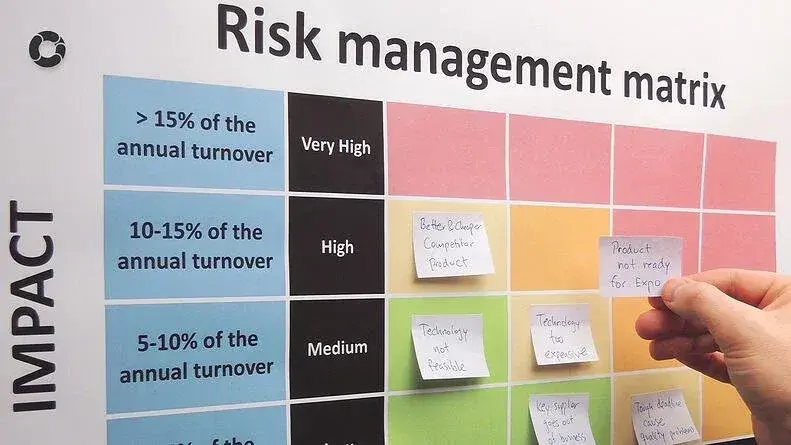

A probability and consequence matrix, also known as a control matrix or risk matrix, is used to classify risks, their sources and management.

Risk matrices are used in different fields to assess and prioritize risk types. These tools combine qualitative or semi-quantitative classifications of consequences and probabilities. This provides a risk level and classification.

A risk matrix in Excel is usually incorporated in the analysis when many risks have been identified. This way, it is possible to select the risks that require more rapid intervention, those that are deemed as priorities or those that need to be scaled up to another level of management. In addition, it also helps to establish which risks are acceptable or unacceptable.

At the same time, the control matrix allows the selection of risks that do not require additional or immediate consideration, allowing the management of resources and efforts in the best way.

That is why risk levels and decision parameters must be aligned with the organization's risk appetite.

Advantages and limitations of risk matrices

The strongest points of the Excel matrix for managing risk are basically:

- It is relatively easy to use.

- It provides a classification of the risks at different levels.

- As you can see, the control matrix is an effective and useful tool, but quite limited.

According to ISO/IEC31010, the risk matrix has several negative aspects that make management difficult.

- It cannot be applied to a wide range of risk events.

- The definition of scales is ambiguous.

- The analysis is very subjective.

- It is difficult to compare the level of risk for different consequences.

Risks cannot be added. In other words, it is not possible to establish equivalence between several low-level risks and one medium-level risk, or between several medium-level risks and one high-level risk.

Risk software, the best tool for comprehensive risk management

For the reasons listed above, risk managers need a tool to help them automate the management process in a structured and systematized manner.

Risk management software is the effective alternative that financial institutions and businesses in general need to carry out this process.

This is because risk software reduces subjectivity, facilitates the decentralization of management, and ensures that the analysis is comprehensive.

Unlike the control matrix created in Excel, risk management software optimizes monitoring, strengthens the risk culture within the company and helps make internal processes visible.

Piraní does all that and makes sure that your company complies with the requirements of regulators and international standards.

You May Also Like

These Related Stories

How to make a risk matrix for your company

Risk Management Software: Why should companies use it?

Excel vs. Cyber-Risk Management Platform: Better Option to Mitigate Risk

Heat map: a tool to optimize risk management

5 risk analysis methods

No Comments Yet

Let us know what you think